House depreciation calculator

If you rent out your home you can deduct the rental income you earn from the house depreciation cost lowering your tax liabilities by removing depreciation cost as expenses on rental income. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

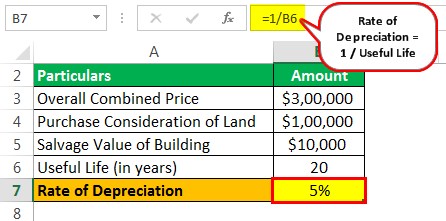

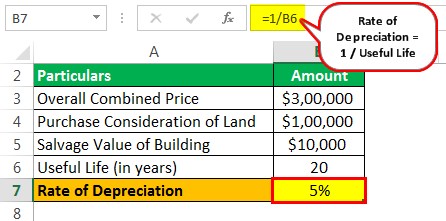

Depreciation Of Building Definition Examples How To Calculate

For example the Washington Brown calculator features each of the alternatives mentioned here in one place.

. You will probably agree that selling it for 20000 again would not be especially fair you have some sort of a gut feeling that it is worth much less now. Find new and used cars for sale on Microsoft Start Autos. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000.

Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered. Capital Works Deductions for New Buildings. Use the BMT Construction Cost Table as a useful guide to determine the cost of building a house as well as a variety of building types.

You can then calculate the depreciation at any stage of your ownership. By entering a few details such as price vehicle age and. For updates on our response to COVID-19.

NW IR-6526 Washington DC 20224. Separate the cost of land and buildings. House depreciation calculator India.

Radicals and Roots Calculator. The following article will explain the. Rather it projects what a given house purchased at a point in time would be worth today if it appreciated at the average appreciation rate of all homes in the area.

After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. Quadratic Formula Calculator - 2nd Order Polynomial. Use this depreciation calculator to forecast the value loss for a new or used car.

Pay back depreciation capital gains etc. Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model. The house and all other non-removable structures.

Use a House Depreciation Calculator. Rent vs Sell Calculator Should I Sell My House. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

BMT Tax Depreciation Calculator. Section 179 deduction dollar limits. Deferred or neglected maintenance is the fastest way to watch your house depreciate.

To use a home depreciation calculator correctly you must first identify three fundamental indicators. The calculator should be used as a general guide only. DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne.

Have complex depreciation claims for example intangible depreciating assets including in-house software an item of intellectual property except a copyright in a film or a telecommunications site access right. 21082016 Help to Buy ISA Savers Blocked From Using Bonus Funds For House Deposit 500000 potential ISA account holders unaware of small print preventing. Capital works constitute the real investment and should be kept in a well-maintained state of repair for maximum return later at the.

Using your myGov account. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. House depreciation is a standard cost deduction process that is used effectively when making a purchase of any house.

After working on the house for several months you have it ready to rent on July 15 so you begin to advertise online and in the local papers. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Bankrates content team which includes four licensed insurance agents with a combined 47 years of insurance industry experience researched hundreds of car insurance companies to find the.

Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most significant one being the family homeRollover provisions apply to some disposals one of the most significant of which are transfers to beneficiaries on death so that the CGT is not a quasi. Identify the propertys basis. Estimate depreciation deductions for residential investment properties and commercial buildings.

Without a myGov account. After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. There are many variables which can affect an items life expectancy that should be taken into consideration.

Our tool is renowned for its accuracy and provides usable. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Estimate depreciation deductions for residential investment properties and commercial buildings.

After a few years the vehicle is not what it used to be in the beginning. If you Rent OutSell Now your property youll have value more wealth in year years. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation.

There are 2 ways you can access the tool. 21082016 Help to Buy ISA Savers Blocked From Using Bonus Funds For House Deposit 500000 potential ISA account holders unaware of small print preventing use of the bonus against the house deposit. Get 247 customer support help when you place a homework help service order with us.

Here is how to use a property depreciation calculator step-by-step. When using the FHFA House Price Calculator please note that it does not project the actual value of any particular house. You can browse through general categories of items or begin with a keyword search.

Another option is to use a house depreciation calculator. The actual value of any house will depend on the local. We welcome your comments about this publication and suggestions for future editions.

A new house purchased for 730000. A small drip from your water heater might not seem like a big deal until it leaks into your foundation and causes it to crack. A new house purchased for 730000.

The Depreciation Calculator computes the value of an item based its age and replacement value. Thus the Other Costs increase significantly if a person were to sell their property in the chosen year. However that is not the case with all depreciation calculators youll find on the internet.

Get a great deal on a great car and all the information you need to make a smart purchase. Random Number Generator 1-10. You find a tenant and the lease begins on Sept.

Anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. BMT Tax Depreciation Calculator. The propertys basis the duration of recovery and the method in which you will depreciate the asset.

Deferred or neglected maintenance.

Depreciation Of Building Definition Examples How To Calculate

Free Macrs Depreciation Calculator For Excel

A Guide To Property Depreciation And How Much You Can Save

Appreciation Depreciation Calculator Salecalc Com

Depreciation Of Building Definition Examples How To Calculate

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Formula Calculate Depreciation Expense

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Depreciation Rate Formula Examples How To Calculate

Double Declining Balance Depreciation Calculator

Appliance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

How Depreciation Claiming Boosts Property Cash Flow

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Investing Investment Property Loan Repayment Schedule